Virtual Mailbox for Insurance Providers

You’ve got policyholders to serve. Let AI handle the mail.

Stable's AI-powered platform helps insurance companies move forward faster, with a virtual mailbox that digitizes your business mail and automates mail-driven workflows.

Trusted by insurance

.webp)

.webp)

.webp)

Transform mail into automated workflows

Handle mail faster

Stable provides insurance companies with instant digital access to their mail, complete with AI-summaries.

Reduce manual processes

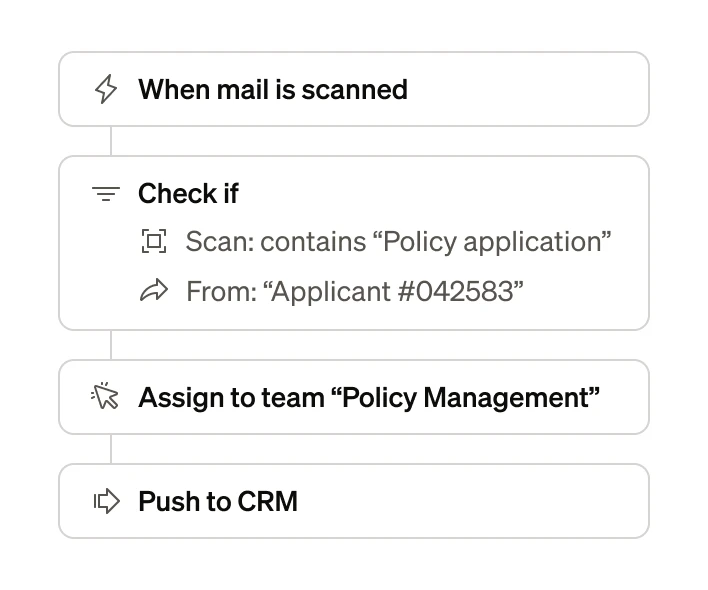

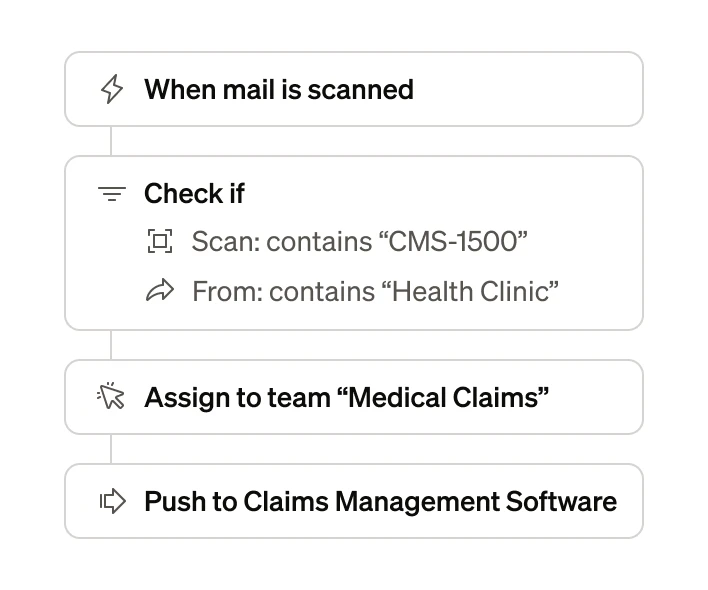

Stable automatically routes mail to the right agents or departments, and pushes information to your insurance tech stack.

Stop worrying about what you’re missing

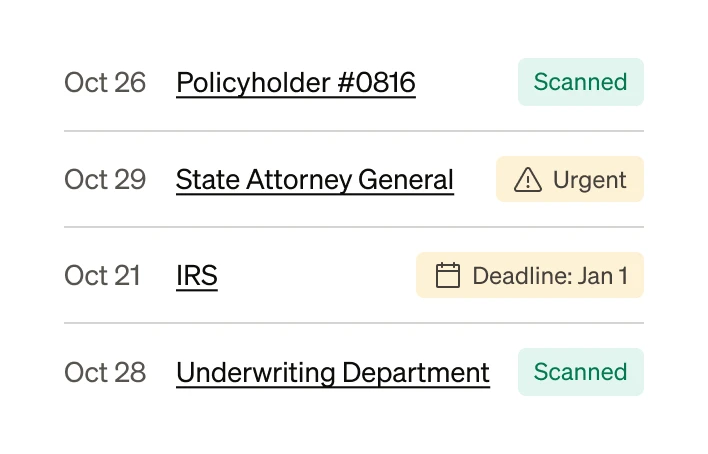

Stable monitors your insurance company for compliance health, flags due dates, and identifies urgent actions.

You can count on Stable

Smarter mail workflows for insurance companies

Join the growing list of insurance companies using our AI-powered platform to unify mail operations across distributed teams.

Get a virtual address

Pick a premium business address to centralize mail operations for your insurance company. Multi-address support available.

We receive and digitize your mail

We receive all of your mail at your new address and process it at our in-house facilities. It’s immediately scanned and uploaded to your Stable platform.

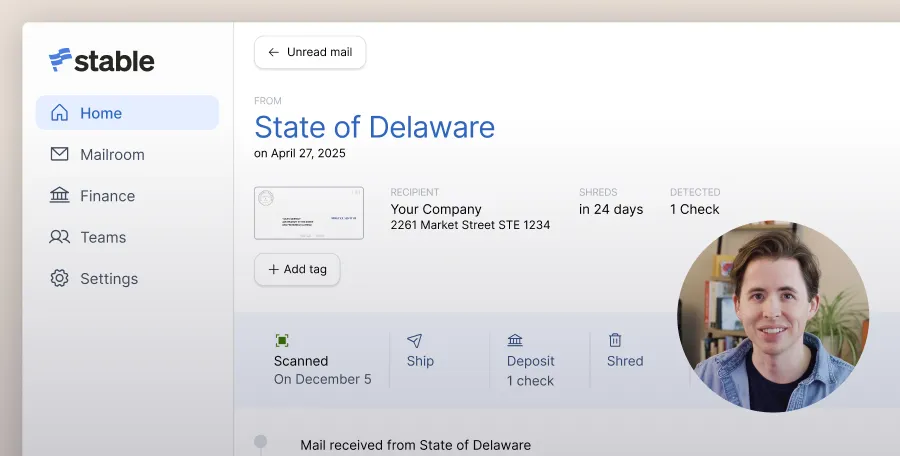

Manage your mail online

From claims documents to checks, act on your mail from anywhere in one AI-enabled dashboard. Automate mail routing, collaborate with colleagues, and be alerted to urgent actions.

Integrate Stable with your favorite tools

Guidewire

Applied Epic

Salesforce

QuickBooks

Vertafore

Duck Creek

OneShield

Dropbox

Guidewire

Applied Epic

Salesforce

QuickBooks

Vertafore

Duck Creek

OneShield

Dropbox

Guidewire

Applied Epic

Salesforce

QuickBooks

Vertafore

Duck Creek

OneShield

Dropbox

An AI-powered mail solution for insurance companies

See how insurance companies use Stable to remove workflow bottlenecks created by mail processing delays, security and compliance obligations, and spikes in mail volume.

Optimize your insurance mail handling

Automate your mail-driven workflows, from policy management to legal correspondence.

Bring mail into your work streams: reduce manual work by pushing information found in the mail directly into your claims or CRM software.

Improve visibility: track and collaborate on mail from anywhere with assignments, tags, and teams.

Speed up payments: eliminate unnecessary bank trips and clear premium checks fast with automated check detection and electronic check deposits.

Expand your insurance operations with confidenc

Scale your operations knowing that mail surges and complex networks won’t hold you back.

Go local: secure real street addresses in major markets that meet regulatory and credentialing requirements, without adding overhead.

Operate remotely: get a distributed team of field agents and remote staff instant access to the mail from anywhere, complete with AI summaries that drive quick action.

Minimize mail handling: process high volumes of mail quickly and get mail to every department, office, or branch efficiently, with AI mail routing.

Ensure policyholder confidentiality

Maintain compliance and policyholder trust with a virtual mail solution backed by enterprise-grade security.

Safeguard PHI and PII: protect policyholder information with a HIPAA-compliant platform.

Control access: ensure only authorized teams — like claims or underwriting — see sensitive mail, with customizable permissions settings.

Hit important deadlines: stay on top of due dates for legal and regulatory mail, with help from automatic notifications and compliance monitoring.

Additional resources

Insights on automating mail-driven workflows for insurance.

Security insurance companies can trust.

Stable is backed by enterprise-grade security and compliance built to protect your mail at every step.

Certified & compliant

Stable is HIPAA-compliant and adheres to SOC2 Type II standards. BAAs available.

Encryption & access controls

Mail data is encrypted, access is permission-based, and every action is logged for auditing and accountability.

Reliable infrastructure

Stable is built to process thousands of documents daily, complete with backups, uptime guarantees, and performance monitoring.

Frequently asked questions

Don't see your question answered? Email us instead.

Yes, Stable offers premium virtual business addresses in major U.S. cities, including all major business hubs and tax-advantaged locations, giving you the flexibility to work from anywhere while maintaining professionalism.

Yes. Stable supports integrations via API and secure file delivery to systems like Guidewire, Duck Creek, Applied Epic, Vertafore, and custom claims platforms. We can automatically route digitized mail — including claims notices, loss runs, medical bills, and policyholder correspondence — into your existing workflows without altering your tech stack.

Stable is built with compliance at its core. Stable is SOC 2 and HIPAA compliant, and all mail is processed in secure facilities with complete chain-of-custody controls. Digital records are encrypted at rest and in transit. Stable is built to process thousands of documents daily, with redundancy, uptime guarantees, and performance monitoring baked in.

Yes. Stable offers secure electronic and mail-in check deposit, with automated check identification. Financial documents are digitized and automatically routed to the right teams, with AI summaries that enable quick action.

If you choose to transition to a Stable virtual address, we’ll provide you with pre-filled forms for quickly updating your address with entities you work with, like the IRS and state, ensuring you don’t miss any critical documents.

Mail scans: Scanned mail is available, searchable, taggable, and actionable as long as you’re a Stable customer!

Physical mail: Physical mail is securely stored for 30 days. After this period, any mail you haven’t forwarded will be securely shredded. Don’t worry, we’ll send you a reminder via email a few days in advance to take any necessary action.

Stable offers registered agent service in all 50 states, ensuring your company meets legal requirements across jurisdictions. If we receive government correspondence at your Registered Agent address, Stable will digitize the documents and notify you through your dashboard, keeping your business operations smooth and compliant.

A virtual mailbox is a secure digital platform that lets insurance providers receive, view, and manage physical mail online from anywhere – no physical mailroom required.

It helps insurers streamline operations, cut costs, and improve customer response times by turning paper mail into actionable digital files. With centralized access and automated, AI-powered workflows, teams can process policies, claims, and client communications more efficiently.

Yes, our platform follows strict healthcare privacy and security standards to ensure all sensitive information remains fully protected.

Stable automatically scans, sorts, and routes mail so claims, policy updates, and customer documents reach the right department instantly. This automation minimizes manual handling and speeds up response times across claims and underwriting teams.

Mail is typically scanned and uploaded to your dashboard within 24 hours of receipt at our processing centers, so your team can take immediate action. Choose our New York, San Francisco, or Dallas virtual address locations for quickest processing times.

Yes, we let you set custom automation rules for forwarding, routing or even depositing checks. Learn more about Stable's automated mail management here.

Absolutely. Stable’s infrastructure is built for scalability and can manage high volumes of insurance-related correspondence daily. Whether you’re handling thousands of claims or hundreds of policy renewals, the platform keeps mail flowing smoothly.

Stable uses enterprise-grade encryption, access controls, and compliance monitoring to protect all sensitive insurance communications and documents. We are also HIPAA-compliant and SOC 2 Type II certified.

Switching to Stable is easy

Save days of time with free assistance from our team as we walk you through compliantly changing your business address to Stable.